Ethereum’s Validation Threshold Is Melting: From 32 to 4 ETH

How Rocket Pool’s Saturn upgrade path aims to lower Ethereum’s validator threshold from 32 ETH toward 4 ETH, reshaping network security from capital concentration into distributed technical infrastructure.

How Rocket Pool and the Saturn upgrade are shifting Ethereum validation from capital-intensive security to infrastructure run by technical operators.

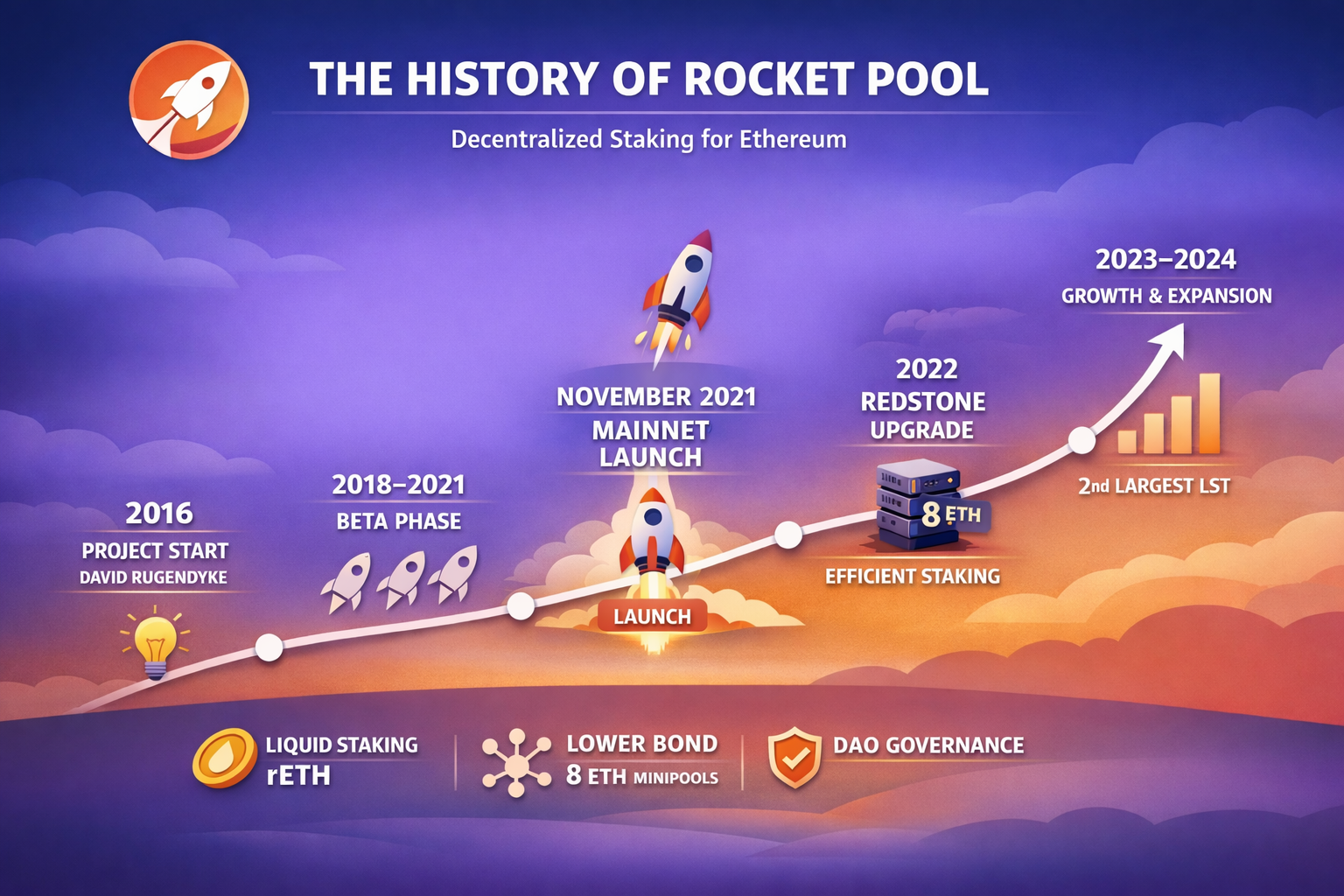

The Rocket Pool project began in late 2016, when Australian developer David Rugendyke started working on a protocol designed as a decentralized solution for Ethereum staking. The idea emerged after Vitalik Buterin published the “Casper” and “Mauve” papers outlining Ethereum’s long-term transition toward Proof-of-Stake.

Rugendyke identified a problem that would only become obvious years later, after the Merge, when Ethereum abandoned Proof-of-Work and moved to Proof-of-Stake. Network security was no longer built on computational power, but on directly locked capital. To participate in validation, one now had to stake 32 ETH.

Mining turned into validation. Energy consumption dropped dramatically, but the financial barrier rose just as sharply.

When network security becomes a capital problem

Those 32 ether are not merely a technical requirement. At today’s valuations, they represent a level of capital that no longer belongs to the domain of experimentation, but to serious financial commitment. A parameter originally introduced to simplify protocol security and limit validator counts has, in practice, become a filter that naturally pushes staking toward funds, custodians, and large operators.

Proof-of-Stake solved Ethereum’s energy problem. It simultaneously created a new one: how can a network remain broadly decentralized when participation requires capital at institutional scale?

If network security is truly grounded in a wide distribution of validators, then the concentration of staking power in a small number of providers becomes not just a market issue, but a protocol-level risk.

This is precisely where Rocket Pool introduces its core idea: role separation. Instead of a single entity providing the full 32 ETH, the protocol allows a validator to be assembled from two components. One part comes from a node operator, who runs the infrastructure and the validator software. The other part comes from many smaller depositors.

What does an Ethereum validator actually do?

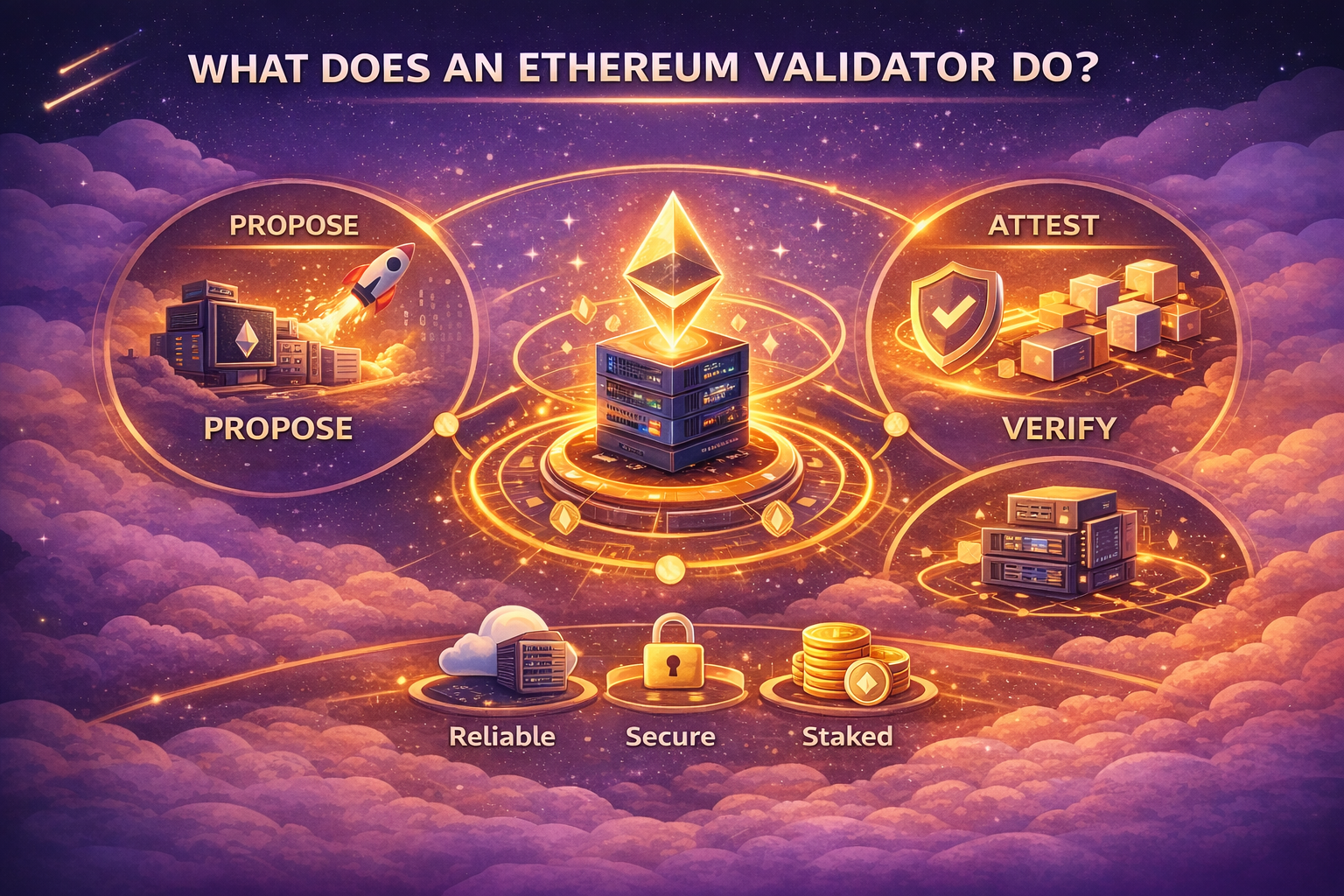

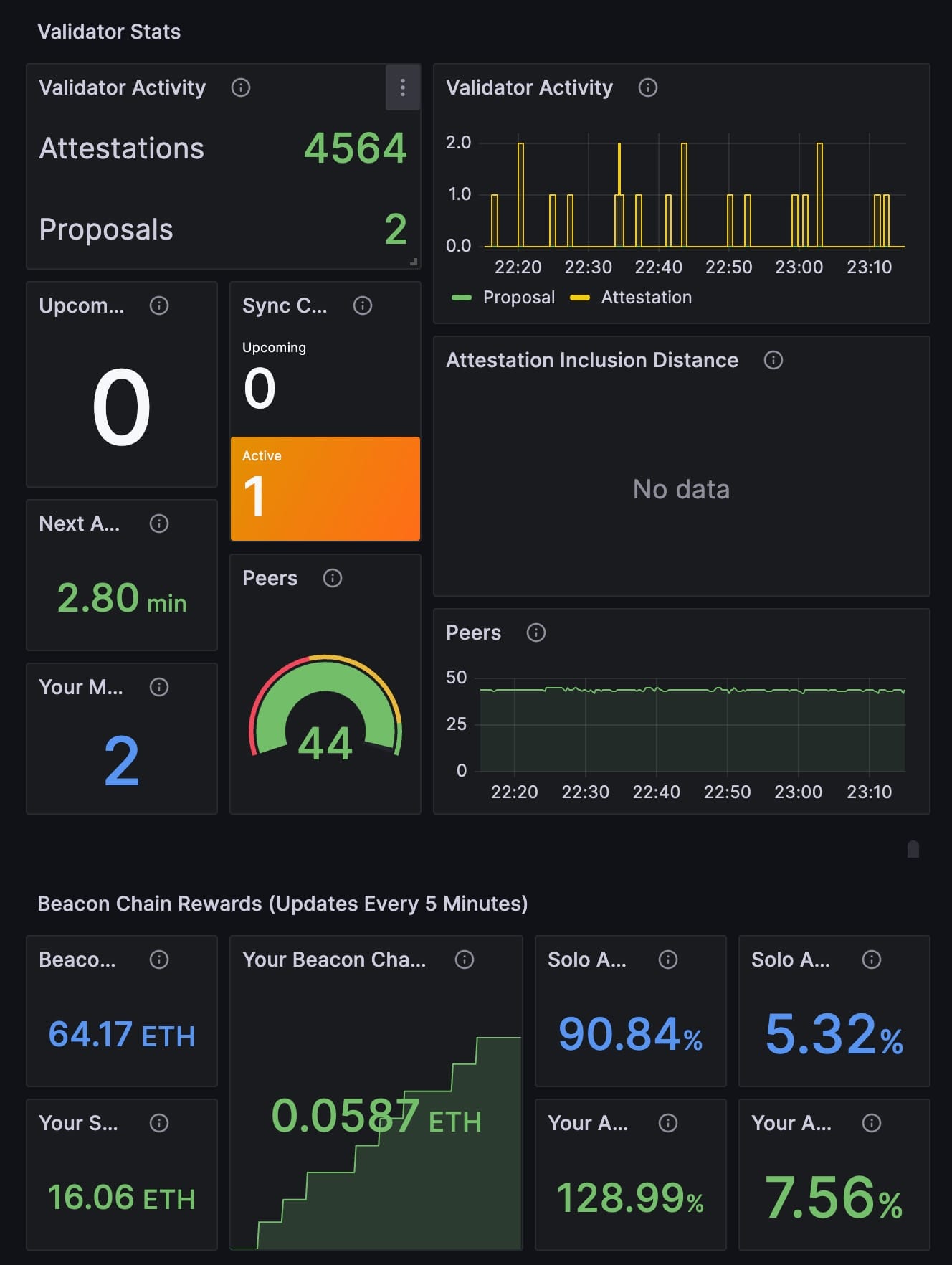

In Proof-of-Stake Ethereum, a validator is no longer a machine burning electricity, but a continuously operating node performing three critical functions: proposing blocks, attesting to blocks proposed by others, and verifying the state of the network.

A validator must remain online, synchronized, and cryptographically ready to sign messages. Correct participation is rewarded. Downtime, technical faults, or prolonged unavailability reduce rewards. Serious violations, such as double signing, trigger slashing — a penalty that permanently removes part of the validator’s stake and ejects it from the system.

Validation no longer demands GPUs. It demands reliable infrastructure, operational discipline, and capital at risk. A validator is no longer a graphics card. It is a long-running server bonded to economic consequences.

Breaking a validator into parts

In its early design, Rocket Pool reduced the capital requirement for node operators from 32 ETH to 16 ETH. The remaining stake is supplied by pooled depositors. Those depositors receive rETH, Rocket Pool’s liquid staking token. rETH represents ETH staked through the protocol and increases in value over time as staking rewards are accumulated.

According to the latest CoinGecko data, 1 rETH is worth approximately 1.15 ETH. rETH therefore usually trades at a premium to ETH, reflecting both accrued staking rewards and the market’s valuation of future yield. This ratio is not fixed and can fluctuate depending on rewards, liquidity conditions, and demand for liquid staking tokens.

Rocket Pool aggregates deposited ETH and uses it as the second half of the validator bond. The psychological and financial threshold is effectively halved: instead of requiring 32 ETH from a single participant, the protocol enables validation with 16 ETH.

After the Merge in September 2022, Rocket Pool’s native token, RPL, took on a deeper role. Rocket Pool was not designed as just another staking service, but as a network of independent node operators who must stake both ETH and RPL. RPL functions as collateral — an additional insurance layer that helps protect depositors in the event of validator penalties.

As the protocol entered full production, demand for RPL grew not as speculation, but as infrastructure. It became a required resource of decentralized validation.

As Proof-of-Stake matured and staking evolved into an industry, Rocket Pool was no longer alone in lowering entry barriers. Competing models emerged that demanded infrastructure and ETH, but not an additional collateral token. In that environment, RPL gradually began to look less like innovation and more like friction.

What running a Rocket Pool validator actually means

A Rocket Pool operator is not someone who “clicks and earns.” They run a full Ethereum node, maintain validator software, handle client updates, monitor security, and ensure continuous uptime. The protocol reduces capital requirements, but it does not remove operational responsibility.

If a validator goes offline, misbehaves, or underperforms, consequences are both financial and reputational. In this sense, Rocket Pool more closely resembles an open network of small operators than a conventional staking service. It does not eliminate expertise. It attempts to remove the capital barrier. Validation returns to the domain of technically capable individuals rather than exclusively professional providers.

Toward validation for ordinary operators

Over time, Rocket Pool has begun revising its own constraints. The “RPL barrier” has not disappeared overnight, but gradually, through protocol upgrades. In mid-2024, for the first time, it became possible to run validators without mandatory RPL bonding. Simultaneously, the required ETH bond dropped from 16 to 8 ETH.

Rocket Pool entered a new zone: validation became feasible not only for large stakeholders, but for technically competent individuals with attainable capital. The next phase, known as “Saturn” and currently planned for early 2026, represents Rocket Pool’s next major upgrade path. Proposed changes target reductions toward approximately 4 ETH. If fully realized, Rocket Pool would enable Ethereum security to be built not only on capital, but again on knowledge, time, and operational commitment, at a threshold eight times lower than Ethereum’s original design.

Why the validator threshold matters systemically

Validator count is not merely a statistic. It directly affects a network’s resistance to outages, regulatory pressure, and coordinated attacks. The greater the number of independent operators across jurisdictions and infrastructures, the harder it becomes to censor transactions or disable the network.

High capital thresholds naturally lead to professionalization — and with it, centralization. Validators move into data centers, controlled by large entities. None of this is inherently wrong. But it changes the character of the network.

Lowering the threshold from 32 to 8, and potentially to 4 ETH, represents a shift back toward a system where Ethereum’s security emerges not only from capital concentration, but from a broad base of small, independent participants.

In that context, Rocket Pool is not merely a staking tool. It is an institutional experiment: can decentralization within Proof-of-Stake be made accessible again to individuals?

This article is part of Crypto Unlocked, a long-term personal hub for understanding blockchain infrastructure, DeFi protocols, and the mechanics of digital money.

© 2026 TC All rights reserved.

This article is protected by copyright law. Any reproduction, distribution, publication, adaptation, storage, or use of this content, in whole or in part, in any form, without the prior written permission of the author is strictly prohibited.

For permissions or licensing inquiries: agemost@protonmail.com