A Digital Pawnshop for the Age of Smart Contracts

DeFi does not digitize finance. It reconstructs it. From automated lending protocols to always-on collateral systems, this article explores how platforms like Aave turn code into financial infrastructure, and why a “digital pawnshop” may be one of the most accurate metaphors for what is emerging.

Automation has pushed checks out of banking, made counters less central, and moved a large part of the financial system into applications. But in the world of cryptocurrencies, that process did not stop at digital versions of existing services. New systems emerged that attempt to build finance without banks, including things once thought indispensable: credit, collateral, and trust. DeFi protocols are therefore not merely applications, but infrastructure in which rules are executed in code.

More than fifteen years ago, an acquaintance of mine found himself in a tax office, walked into a room full of clerks, and, visibly angry, said out loud: “Very soon, all of you will be replaced by a single SQL Server.” At the time it sounded exaggerated. Today, it is hard not to notice that the world has, slowly, been moving in that direction.

Automation as a sign of the times

In banking, for example, checks have disappeared, counters are no longer at the center of the story, and much of the work has moved into applications. I am not claiming this happened overnight, nor that everything works perfectly. But the trend is clear: whenever something can be automated, sooner or later it usually is.

You can see this outside of banking as well. Not long ago, I called a local tax office. After repeated attempts, a man finally answered and calmly explained that they are understaffed, that few people apply for open positions, and that the system is simply stretched close to breaking point.

There is no need to dramatize it. But as a snapshot of our time, it feels telling. Automation does not arrive only as “technological progress,” but also as a response to a lack of people and the need to cut operational costs.

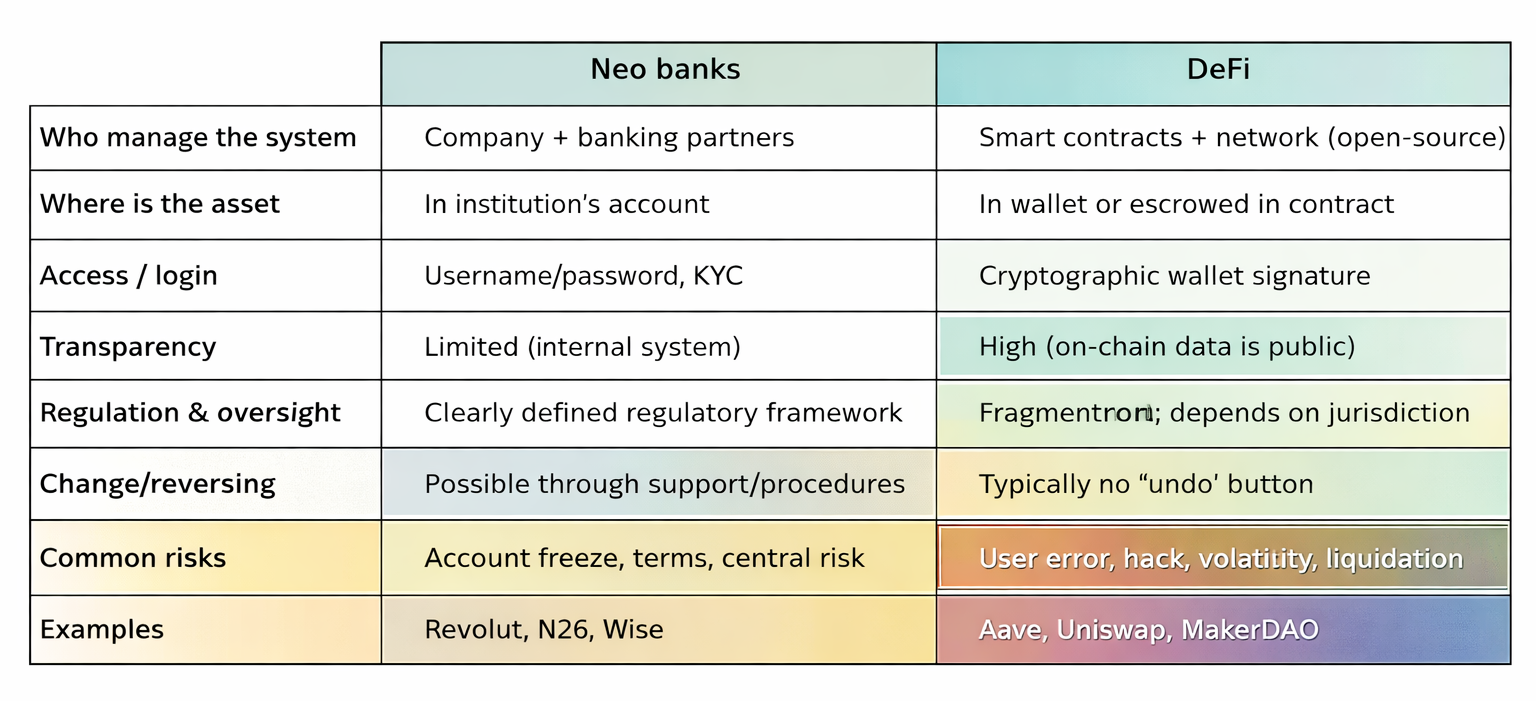

Neo-banks are not DeFi

In the world of cryptocurrencies and decentralized finance — still outside the comfort zone of the average citize, a similar shift happened even earlier. There, so-called neo-banks, digital banks without physical branches, are already yesterday’s news. Neo-banks can be seen as traditional banks without counters, but with modern applications. Revolut, N26, Monzo, or Wise are good examples. They are fintech companies. They operate in a centralized manner. They have management, headquarters, and regulatory frameworks in which they must play by the rules.

DeFi services such as Aave, Uniswap, Curve, or MakerDAO belong to a different category. These are not banks in digital packaging, but collections of smart contracts that live on blockchains. In practice, this means that the “system” is not a single company, but code executed across a network.

That is why it is misleading to place everything under the same label of “digital finance.” Digital banks are centralized services that someone operates and someone is responsible for. DeFi is, by construction, more decentralized and harder to reduce to a single address or jurisdiction.

Take Ethereum, the most decentralized blockchain providing infrastructure for DeFi services. Smart contracts on Ethereum run on a network today secured by hundreds of thousands of active validators, with infrastructure and nodes distributed across countries on six continents.

Where your money actually lives, and who controls it

Another fundamental difference between DeFi services and digital banks is where your money “is.” In digital banks, funds sit in accounts maintained by an institution (or its banking partner). In DeFi, assets are in your wallet or locked in smart contracts, but the key point is that control remains with you, through your private keys.

Modern web3 applications try to make this control “comfortable,” so users often interact by signing transactions in a wallet with a single click, rather than typing passwords or long key strings where at least one mistake is almost inevitable.

If we simplify: web1 was the internet for reading (websites, portals, forums), web2 the internet for participation (social networks, web apps, cloud computing), and web3 the internet for ownership — where applications and money rely on blockchains, and users control keys, assets, and access. In web2, your account “lives” on a company’s server. In web3, the “account” is your wallet, and access is not controlled by a password, but by a cryptographic key pair you hold. That is why DeFi protocols like Aave are typical examples of web3: there is no central institution keeping accounts, but a network and code that anyone can verify.

Trust without counters

The third difference between digital banks and DeFi services is trust. With digital banks, you trust the institution — to keep records, follow rules, and provide procedures when problems arise. DeFi takes a different path: rules are embedded in code, and transactions are publicly verifiable on blockchains. This is more transparent, but it comes at a price. If you make a mistake, there is often no “someone” who can undo it. Figuratively speaking, digital banks modernize the existing system. DeFi attempts to build an alternative that touches the legacy system only at the edges. This is the third key difference — and why neo-banks and DeFi are only superficially “similar.”

Why DeFi is still not mainstream

There are many reasons, but one stands first: insecurity. People do not like systems they do not understand, especially when money and savings are involved. Another is the level of personal engagement required. You must know what you are signing, what you are doing, how you store keys, and how you assess risk. That knowledge is often acquired informally, through reading, experimentation, and mistakes — and for most people, this is simply too high a barrier. In DeFi, when something goes wrong, there is usually no counter, no customer support, and no “undo” button. Perhaps that is why only now a generation is slowly forming that will experience such systems more naturally. Not because they are “braver,” but because it feels normal to them that parts of life unfold through software rather than through counters.And then that sentence from the tax office, spoken in anger years ago, begins to sound less like provocation and more like a description of a world that arrived almost unnoticed.

Aave as a digital pawnshop

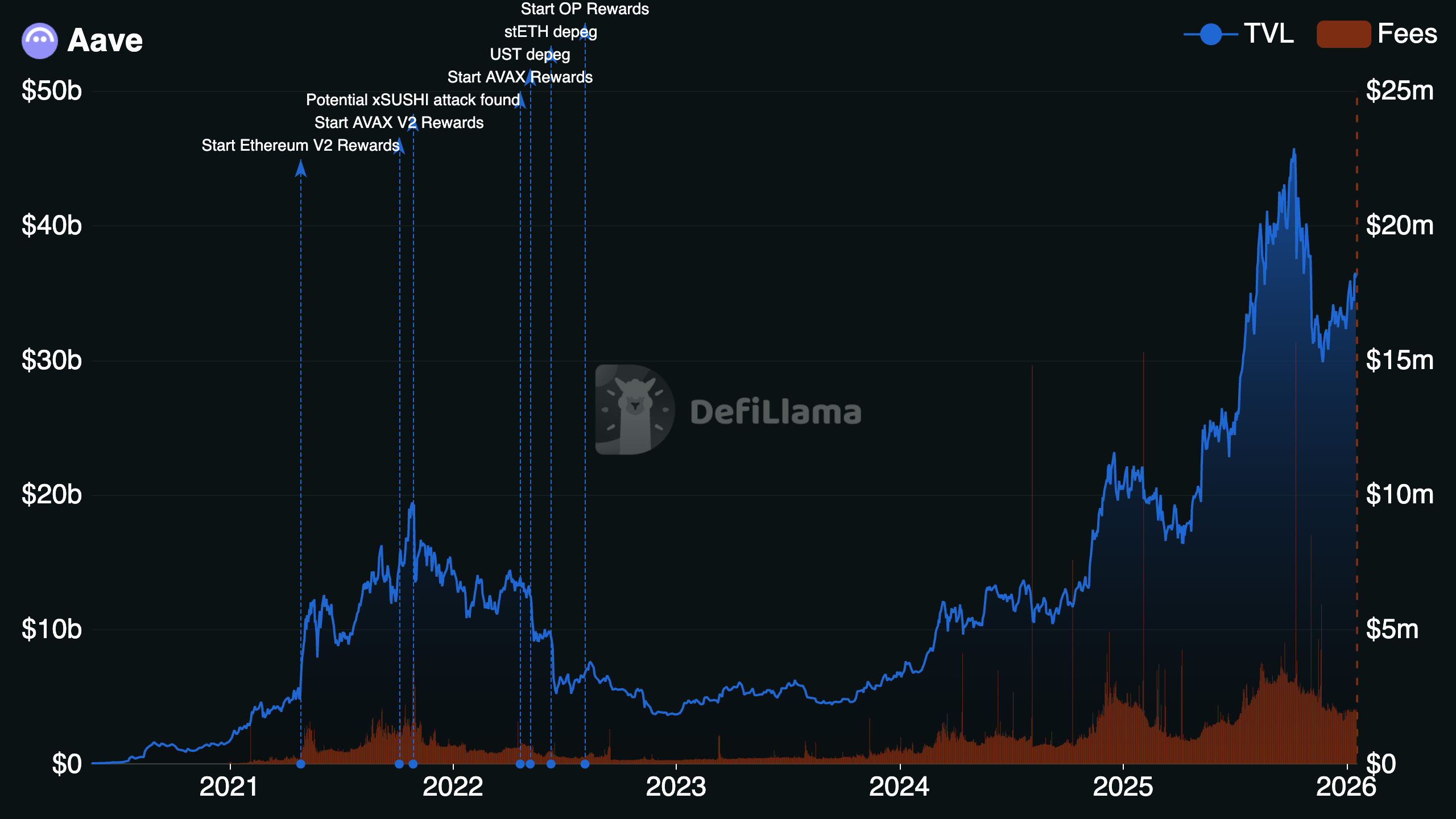

Why does the curve of assets locked in DeFi protocols keep rising?

One answer can already be seen in the example of the currently largest DeFi protocol by TVL, Aave. TVL stands for Total Value Locked — the total amount of cryptocurrency locked in a protocol’s smart contracts at a given moment. The higher the TVL, the more users are holding assets there, whether for lending, providing liquidity, or earning yield. This makes TVL one of the key indicators of real DeFi usage.

Aave can be understood as a kind of digital pawnshop. Users lock cryptocurrency into smart contracts as collateral and borrow other assets against it, most often stablecoins pegged to the US dollar. They do not sell their underlying assets, but temporarily place them as collateral in order to obtain liquidity. Everything functions automatically, according to predefined rules in code, without intermediaries, without officer assessments, and without working hours.

Collateral as strategy, not necessity

Why would someone lock digital assets and then spend borrowed stablecoins, paying interest?

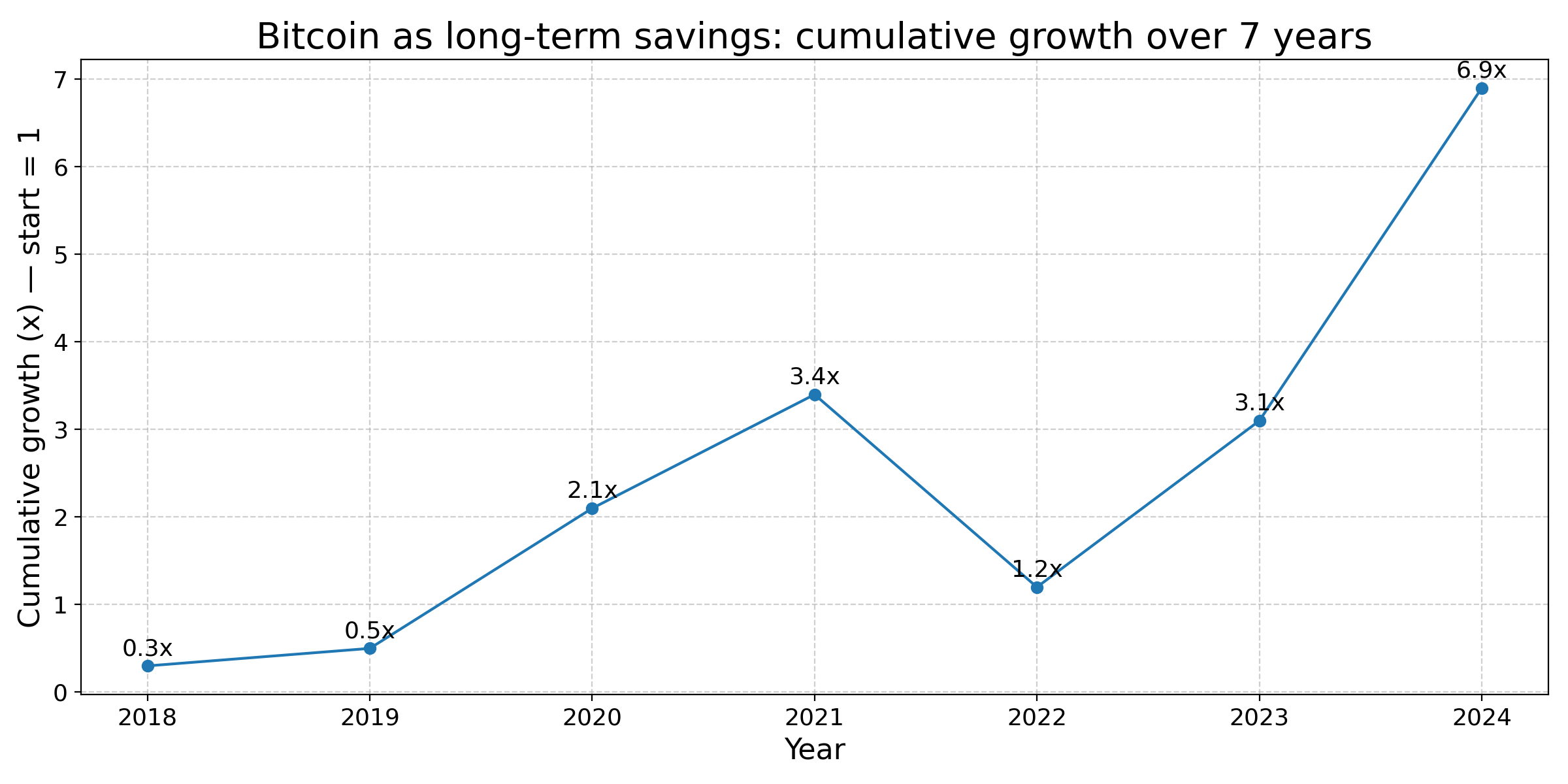

The answer lies in long-term charts. If someone chooses Bitcoin as a form of long-term savings for example over the past seven years ,volatility stops being only a risk and becomes an ally. Over time, it often represents precisely the “noise” that scares in the short term, while enabling returns that are difficult for the average person to access in traditional finance.

Loan size and risk depend on the value of collateral. If it falls too far, the system automatically closes the position to protect protocol liquidity. That is why Aave is not merely a “place for interest,” but infrastructure for credit in which assets remain owned by the user, but are temporarily locked as guarantees. In practice, this means Bitcoin, Ether, and other tokens are increasingly used not as assets that must be sold, but as collateral from which liquidity is extracted. This logic underpins the growth of TVL: assets are not parked passively, but enter systems that turn them into functional financial tools.

When a pawnshop becomes infrastructure

If pawnshops were once seen as symbols of necessity, their digital version is increasingly appearing as a strategic tool. Not as a place one goes when there is no other choice, but as infrastructure within which assets stop being static and become active. In that world, you no longer ask where the nearest counter is. You ask how secure the code is, who executes it, and under what conditions. Perhaps that is why Aave is more interesting as a phenomenon than as a service. Not because it enables borrowing without banks, but because it shows how financial relationships can be reorganized around software rather than institutions.

As with that SQL Server in the tax office, change does not arrive with fanfare. It arrives quietly, through tools that at some point stop being “alternatives” and become infrastructure. When that happens, a pawnshop without counters will no longer sound like a metaphor, but like a description of the system we live in.

This article is part of Crypto Unlocked, a long-term personal hub for understanding blockchain infrastructure, DeFi protocols, and the mechanics of digital money.

© 2026 TC All rights reserved.

This article is protected by copyright law. Any reproduction, distribution, publication, adaptation, storage, or use of this content, in whole or in part, in any form, without the prior written permission of the author is strictly prohibited.

For permissions or licensing inquiries: agemost@protonmail.com